Comprehensive Accounting Services

We provide a full suite of financial services designed to support your business at every stage.

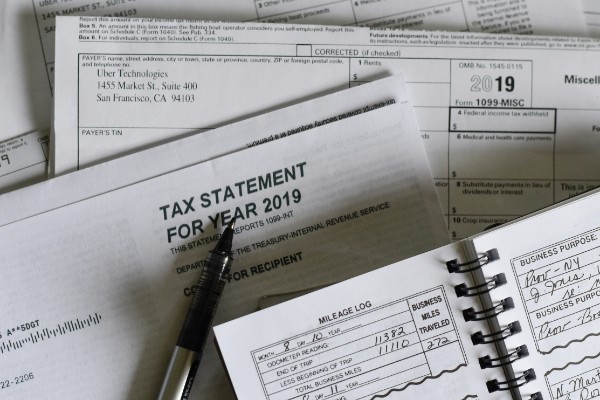

Tax Compliance

- Tax returns for individual, partnership, company and trust

- ATO correspondence handling

- Free initial consultation

- Capital gains advice

- Tax planning strategies

Indirect Tax

- Monthly/Quarterly BAS preparation and lodgement

- PAYG calculations

- Fuel tax credits calculation

- Fringe Benefits Tax (“FBT”)

- Payroll Tax

Business Advisory

- Business structure advice

- Cash flow management

- Tax planning strategies

Bookkeeping Services

- Daily transaction recording

- Bank reconciliation

- Monthly financial reports

- Payroll processing